2021 was a year of both challenge and progress for the chemical and life sciences fields. As we came to terms with the ongoing COVID-19 pandemic, new variants emerged which posed new questions and spurred research to learn more about the nature of the virus and these mutations. Despite remote working, social distancing, and the necessary implementation of new ways of working together, positive change continued at pace, making great strides in many research, development and therapeutic areas.

In December 2021, members of the C&EN Executive Editors Michael Torrice and Michael McCoy, along with a small group of experts, looked ahead to 2022 and presented their predictions for this year in terms of the chemical and life sciences industries. Here, we highlight some of those predictions.

Prediction #1: Continued, increased focus on environmental matters and sustainability.

Looking ahead to this year, one thing that is abundantly clear is that long-term environmental and sustainability trends that were overshadowed by the pandemic will re-assert themselves this year. Those trends include more sustainable food and confronting the plastic waste problem. Of course, a serious resurgence of COVID-19 could affect things quickly, but the C&EN team expects to see an economic revival, with mergers and acquisitions driven by climate and sustainability goals.

Large corporations, for example, BASF, Mitsubishi, and Trinseo, amongst others, will shift portfolios away from fossil fuel-related products. In addition, new corporate directions will lead to rebranding and promotion opportunities (for example, Curia, Pharmteco, EuroAPI, Arxada, and Aviant. Investors are expected to back SPACs (Special Purpose Acquisition Companies) and IPOs for cleantech companies such as Danimer, PureCycle, Ginkgo Bioworks, Zymergen, and Solid Power, on the back of the more than $1 billion in venture capital that went to biobased fuel and chemical companies in 2021.

“In organic chemistry, I expect that we will see the trend of skeletal or molecular editing continue to grow…

“The question is very captivating: can you take a complex molecule and turn it into a very different one (that would take many steps to make) by one simple synthetic transformation? I anticipate that chemists will build on [results from this year] to quickly get their hands on new, complex molecules that will have important biological functions.“

— Corinna Schindler, University of Michigan

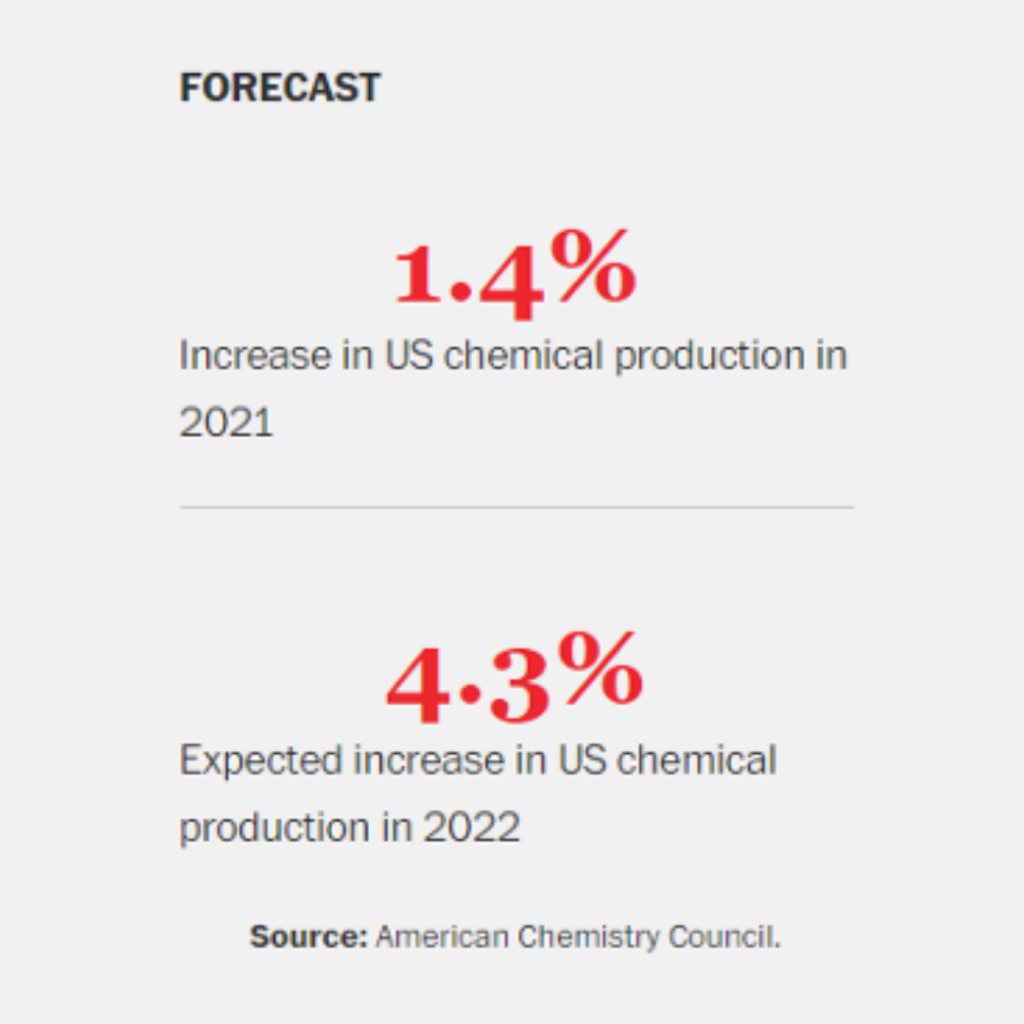

Prediction #2: 2022 should be the real rebound year for the US chemical industry. In Europe, environmental drivers will dominate

In 2021, a sustained and robust return to tangible growth was severely hampered by supply chain problems on the coattails of the COVID-19 pandemic. As countries and organizations continue to navigate the new landscape, the easing of supply chain constraints should pave the way for stronger growth in 2022. Cutting carbon emissions through the ongoing electrification of the automotive industries is expected to further drive (no pun intended) mergers and acquisitions. Growth may be tempered to a degree though, due to inflation rates, the strongest in a generation, that emerged in 2021.

In Europe, the EU’s ‘Green Deal’ will raise costs for companies that produce chemicals in Europe. These new regulations could impact production of up to 12,000 chemical substances, although the push towards a hydrogen economy will create significant opportunities for chemical manufacturers.

Prediction #3: The pharmaceutical industry is coming through the pandemic stronger than ever.

2022 promises to be a strong year for pharmaceutical companies. Pfizer, for example, anticipates $36 billion in COVID-19 vaccine sales this year, and we can expect COVID-19 antivirals to foment a secondary wave of sales.

In the midst of the continuing pandemic, drug approvals were high. In 2021, the FDA approved 50 novel drugs never before approved or marketed in the U.S., in addition to a number of approved drugs in new capacities, such as for new uses and patient populations. Despite investment in, and publicity for, new therapeutic modalities such as antibody drugs and gene and cell therapies, traditional small molecules -the products of medicinal chemistry – continue to dominate drug approvals. In fact, around two thirds of drugs approved were small molecules invented by medicinal chemists.

Notable stats from the FDA, according to an article by Patrizia Cavazzoni, M.D., Director, Center for Drug Evaluation and Research (CDER), include:

- First Cycle Approvals: In 2021, the CDER approved 43 of the 50 novel approvals (86%) on the first cycle. This contrasts with CDER not approving the drug at first and possibly asking the applicant for more information.

- Approvals Before Other Countries: 38 of the 50 novel drugs approved in 2021 (76%) were approved in the U.S. before being approved in another country.

- Expedited Programs for Serious Conditions: the FDA has four programs to facilitate and expedite development and review of drugs for serious or life-threatening conditions: Fast Track designation, Breakthrough Therapy designation, Priority Review designation, and Accelerated Approval.

- In 2021, 37 of the 50 of CDER’s novel drug approvals (74%) used one or more of these expedited programs, which helped bring new therapies to the market sooner than expected.

What’s more, demand for medicinal chemists heated up the job market in 2021 and we can expect this to continue in 2022.

“After a little over a decade of excitement and development, 2022 is likely to be the year in which perovskite photovoltaics will finally see the light at a commercial stage…

“Simultaneously, perovskites and perovskite-inspired materials will further venture into new territories beyond solar cells and LEDs. Frontier applications, such as spintronics, detectors, transistors, and catalysts are some of the exciting avenues that the field will undoubtedly be exploring.”

— DiegoSolis-Ibarra, National Autonomous, University of Mexico

Prediction #4: The pharmaceutical outsourcing sector, buoyed by pandemic business, is investing significantly

Operating conditions have been affected by supply chain challenges, personnel being forced to isolate or remote work, and the net result has been a tightening of capacity within the pharmaceutical industry. This crunch on capacity has acted as a red flag, spurring investment as the industry pushes to meet demand. Small-molecule production expansions remain key to growth, so expect to see ongoing investment and focus there.

2021 saw an increase in ‘reshoring,’ the practice of transferring a business operation that was moved overseas back to the country from which it was originally relocated, as supply chain challenges were significant. Expect this trend to continue in 2022. Another trend we can expect to see this year is investors acting on the back of more roll-up potential. A roll-up (or consolidation) describes a company built primarily via smaller acquisitions with common services or products. Value will be created by building larger, more scalable entities that command higher overall market valuations. Current examples include Novasep/PharmaZell, and Aceto.

Outsourcing continues to assume great significance, particularly given the capacity squeeze seen in the past two years. COVID-19 vaccines and therapeutics are filling outsourced manufacturing plants, while advances in cell and gene therapy continue to expand a new frontier in drug development and outsourced support. New therapeutic technologies such as ADCs, protein degraders, covalent drugs, require new synthesis technology, and it may be faster and initially cost-effective to outsource until in-house capacities come on-stream.

Many of these new drugs were discovered by biotech companies, a term that includes companies developing traditional chemical small molecules. The financial health of the biotech industry is measured in two ways: By start-up financing – when companies get their first significant venture capital investment – and IPOs – when they become mature enough to sell stock to the public. On both fronts the industry is outperforming and we expect it to continue to do so. More than 100 start-up companies raised more than $20 billion in series A funding last year, a record, and initial public offerings of drug companies also set a record.

“I will be watching for new biological insights generated from analytical chemistry and computational structure prediction tools [for metabolites]! A key step will be increasing confidence in the output of in silico tools, especially with regards to rankings of predicted structures.

“I also think that we’re all hungry to reclaim the sense of community that was lost during the pandemic. This may lead to a growth in collaborative research projects, with new perspectives on the ‘tough questions’”

— Laura-Isobel McCall, University of Oklahoma

Despite the ongoing COVID-19 situation, there is reason to be optimistic as we move through 2022. We are learning to navigate this new economy through new practices, enhanced communications, while supply chain challenges are starting to be resolved. It can be argued that the role of clinical research and development, pharmaceutical production and getting therapeutics to improve patient outcomes is more important than ever as viral variants emerge. Working together to solve ongoing challenges, therefore, has to be our top priority as a society.